Why Would The Government Spend More Money During A Financial Recession?

ane.7 Government'due south Role in Managing the Economy

Learning Objective

- Discuss the government's part in managing the economy.

In every country, the government takes steps to assist the economic system achieve the goals of growth, full employment, and price stability. In the United States, the government influences economic activity through two approaches: monetary policy and fiscal policy. Through budgetary policyEfforts exerted by the Federal Reserve Arrangement ("the Fed") to regulate the nation's money supply. , the government exerts its power to regulate the money supply and level of interest rates. Through fiscal policyGovernmental employ of taxation and spending to influence economic conditions. , it uses its ability to tax and to spend.

Budgetary Policy

Monetary policy is exercised by the Federal Reserve System ("the Fed"), which is empowered to take various deportment that decrease or increase the money supply and raise or lower short-term interest rates, making it harder or easier to borrow money. When the Fed believes that inflation is a problem, information technology will employ contractionary policy to decrease the money supply and raise involvement rates. When rates are college, borrowers have to pay more for the money they borrow, and banks are more selective in making loans. Considering money is "tighter"—more expensive to borrow—demand for goods and services will get downwards, and and so volition prices. In whatsoever case, that's the theory.

To counter a recession, the Fed uses expansionary policy to increase the coin supply and reduce interest rates. With lower involvement rates, information technology's cheaper to borrow money, and banks are more willing to lend information technology. We so say that money is "like shooting fish in a barrel." Attractive interest rates encourage businesses to borrow money to aggrandize production and encourage consumers to buy more goods and services. In theory, both sets of actions will help the economy escape or come out of a recession.

Financial Policy

Fiscal policy relies on the government'south powers of spending and tax. Both taxation and government spending can be used to reduce or increase the full supply of money in the economy—the total corporeality, in other words, that businesses and consumers have to spend. When the country is in a recession, the appropriate policy is to increase spending, reduce taxes, or both. Such expansionary actions will put more than money in the hands of businesses and consumers, encouraging businesses to expand and consumers to purchase more goods and services. When the economic system is experiencing inflation, the opposite policy is adopted: the government will decrease spending or increment taxes, or both. Because such contractionary measures reduce spending past businesses and consumers, prices come up down and inflation eases.

The National Debt

If, in whatsoever given twelvemonth, the government takes in more than coin (through taxes) than it spends on appurtenances and services (for things such every bit defense, transportation, and social services), the event is a upkeep surplus. If, on the other hand, the government spends more than it takes in, we have a budget deficit (which the government pays off past borrowing through the issuance of Treasury bonds). Historically, deficits have occurred much more often than surpluses; typically, the regime spends more than information technology takes in. Consequently, the U.Southward. government now has a total national debtTotal amount of money owed by the federal government. of more than $14 trillion.

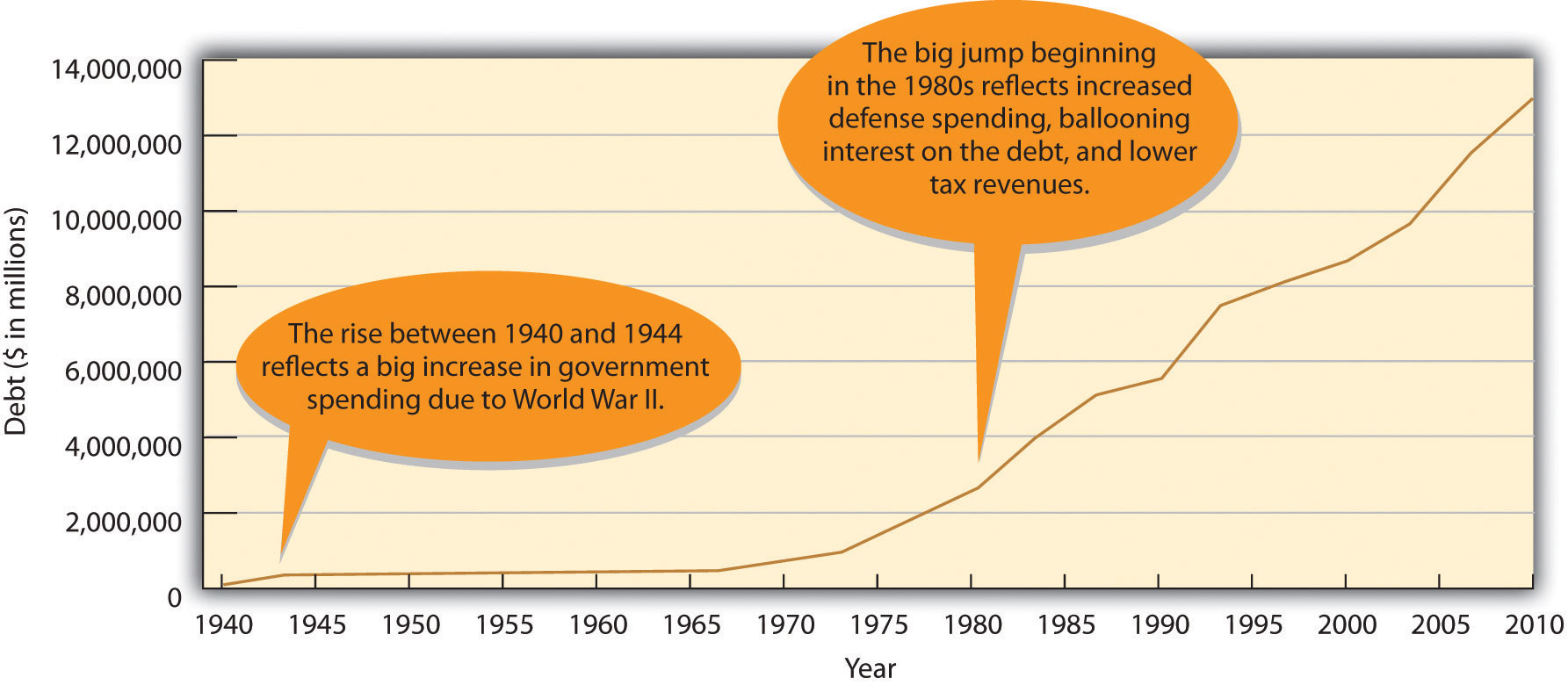

As y'all tin see in Effigy 1.13 "The U.S. National Debt, 1940–2010", this number has risen dramatically in the concluding sixty-five years. The significant jump that starts in the 1980s reflects several factors: a big increase in government spending (especially on defense force), a substantial rise in involvement payments on the debt, and lower tax rates. Equally of this writing, your share is $46,146.21. If y'all want to see what the national debt is today—and what your electric current share is—get on the Web to the U.S. National Debt Clock (http://world wide web.brillig.com/debt_clock).

Figure 1.13 The U.South. National Debt, 1940–2010

Macroeconomics and Microeconomics

In the preceding discussion, we've touched on two main areas in the field of economics: (1) macroeconomics, or the report of the economy as a whole, and (ii) microeconomics, or the study of the economic choices made past individual consumers or businesses. Macroeconomics examines the economy-broad effect of inflation, while microeconomics considers such decisions every bit the price you're willing to pay to go to college. Macroeconomics investigates overall trends in imports and exports, while microeconomics explains the price that teenagers are willing to pay for concert tickets. Though they are ofttimes regarded as separate branches of economics, we can gain a richer agreement of the economy by studying issues from both perspectives. As we've seen in this chapter, for case, you can better understand the overall level of activeness in an economic system (a macro issue) through an understanding of supply and need (a micro issue).

Central Takeaways

- The U.Southward. regime uses two types of policies—monetary policy and financial policy—to influence economic operation. Both have the aforementioned purpose: to assistance the economy achieve growth, total employment, and price stability.

- Monetary policy is used to control the coin supply and interest rates.

- It's exercised through an independent authorities bureau called the Federal Reserve Organisation ("the Fed"), which has the power to control the coin supply and interest rates.

- When the Fed believes that inflation is a problem, it will apply contractionary policy to decrease the money supply and enhance interest rates. To counter a recession, information technology will use expansionary policy to increase the money supply and reduce interest rates.

- Fiscal policy uses the government's power to spend and tax.

- When the land is in a recession, the regime will increase spending, reduce taxes, or do both to expand the economic system.

- When we're experiencing aggrandizement, the government volition decrease spending or increment taxes, or both.

- When the regime takes in more coin in a given year (through taxes) than information technology spends, the event is a surplus.

- When the opposite happens—government spends more than money than it takes in—we have a deficit.

- The cumulative sum of deficits is the national debt—the total amount of money owed by the federal government.

Exercises

- Allow'south say that yous're the Fed chairperson and that the state is in a recession. What actions should the Fed have to pull the country out of the recession? What would you suggest authorities officials to do to improve the economy? Justify your recommendations.

- Browsing through your college's catalog, you notice that all business majors must take two economic science courses: macroeconomics and microeconomics. Explain what's covered in each of these courses. In what ways will the things you learn in each course help you lot in the future?

Source: https://saylordotorg.github.io/text_exploring-business-v2.0/s05-07-government-s-role-in-managing-.html

Posted by: coonsnaturawrove.blogspot.com

0 Response to "Why Would The Government Spend More Money During A Financial Recession?"

Post a Comment